FORUM

When to Involve a Banker in Your Search Fund Process

The question of when to engage with a banker is common amongst small business buyers. Lisa Forrest of Live Oak Bank provided her thoughts in a recent article.

“A typical search fund will screen hundreds of potential deals over the course of the search phase. With so much work to do — and the eventual need for a bank loan on the horizon — the question of when to involve a banker in the search fund process is an important one. With the right approach, this element of the search can be used to help accumulate information from which to make a better final lender choice when your deal has an accepted letter of intent and is ready for the closing process.”

“Finding an experienced bank to work with throughout the search fund process can be tricky. At the introductory stage, it may be wise to contact approximately five or six banks, prioritizing lenders with positive referrals from past searchers.”

Read the full article here.

Equire is a marketplace for entrepreneurs to find and invest in traditional SMB's with $700k to $7m EBITDA. The Equire DealSource service helps Entrepreneurs find companies to acquire and operate, and the Equire DealFund service then helps entrepreneurs efficiently obtain capital from accredited investors to close their acquisition. For more information please visit equire.co or email info@equire.co.

"How CEOs-in-waiting buy the companies they want to run"

In a Fast Company article, Edmund Andrews introduces readers to the “search fund “concept, and explains why and how MBAs are turning to search funds as a means of running their own businesses.

“In a search fund, entrepreneurs–often newly minted MBAs–find investors to finance and mentor them. In the search phase, investors essentially pay the entrepreneur to scour the country for a company with potential. In the acquisition phase, the investors back the entrepreneur with capital to buy the company, and some of them provide guidance to build it into something bigger.”

“There has been tremendous growth in the past 10 years, and it’s been driven by entrepreneurs who want to become owner-managers without starting their own companies from scratch,” Kelly says. “These are solid companies in very attractive industries, and the entrepreneurs buying them are on their way to becoming excellent CEOs. They’re just inexperienced and need mentoring to be successful.” -Peter Kelly

“What drives young MBAs or mid-career executives to launch search funds? The most common trait, Kelly says, is the desire to own and lead a company. For people right out of graduate school, who usually don’t have the track record to run a large enterprise or the money to buy a company on their own, search funds offer a way to become owner-managers without having to build a business from the ground up.”

“The average purchase price in 2017 was $13.1 million. As with traditional private equity funds, investors provide equity capital for a substantial part of the purchase price and borrow the remaining amount.”

Read the full article in Fast Company.

Equire is a marketplace for entrepreneurs to find and invest in traditional SMB's with $700k to $7m EBITDA. The Equire DealSource service helps Entrepreneurs find companies to acquire and operate, and the Equire DealFund service then helps entrepreneurs efficiently obtain capital from accredited investors to close their acquisition. For more information please visit equire.co or email info@equire.co.

Alternatives To The Traditional Startup/VC Route

In a recent Forbes article, Brendan Burns, a technology investor and Columbia Business School professor, discusses finding and turning around existing businesses as an alternative to the traditional startup route.

"I wanted to move fast and create a company that would capitalize on these trends—but I did not want to start a company from scratch... Instead, I decided on a shortcut that would look a lot like my work with early-stage startup turnarounds. After leaving (my previous venture) armed with trend information and working knowledge of the industry, I formed a holding company (set up sort of like a search fund), put my value investing cap on and started looking for a company to acquire."

"How were we able to do this? Simply, value investing 101. Venture investors use “venture math” —90 percent of their returns come from less than five percent of their investments. Therefore, if something does not look like it will be a home run, the rational path for the investor is to stop investing time and money, thus creating an “orphan company”. But is the company worthless? Not to me. Look at See.Me: Over five years of brand building, over 400,000 Facebook followers and over 1,100,000 email subscribers. What would it cost to build that organically? At least five years, $4.5 million and probably a lot of luck as well."

"Between 2006 and 2016 there was at least $20 billion invested in 8,000 startups. The vast majority failed to deliver on investor expectations. Was all that money wasted? I doubt it. Today there are credible alternatives to building companies and raising capital."

Read the full article in Forbes.

Equire is a marketplace for entrepreneurs to find and invest in traditional SMB's with $700k to $7m EBITDA. The Equire DealSource service helps Entrepreneurs find companies to acquire and operate, and the Equire DealFund service then helps entrepreneurs efficiently obtain capital from accredited investors to close their acquisition. For more information please visit equire.co or email info@equire.co.

How universities could drive more innovative research to market — and share in the profits

In a VentureBeat article, Tim Schigel of Refinery Ventures discusses how search fund investments could pose attractive opportunities for university endowments to invest in talented entrepreneurs associated with their universities and target strong IRRs.

"In the early 1980s, Irving Grousbeck and his colleagues at Stanford Business School launched a revolution in the way that entrepreneurs and investors fund, manage, and grow mature businesses. Their creation — the search fund — changed the way many investors thought about equity investments, turning fund managers into quasi private equity shops and posting impressive returns as a result."

"Some Chief Investment Officers at major university endowments have shared with me that they are frustrated with the current restrictions they face and that they believe a venture search fund model would solve their structural problems. As a VC that straddles the Valley and the Midwest, another theme that’s always on my mind is how to help propagate an innovation mindset throughout middle America – and universities are often the hub around which innovation ecosystems develop... So I believe it’s time for universities and VCs to start experimenting with this kind of model."

"By partnering with a university’s entrepreneurship office.... these entrepreneur “jockeys” would have the runway to explore their business concepts, and they would be incentivized to license technologies from sponsoring universities. This would give endowments access to high-growth commercialization opportunities and, by partnering with experienced venture capital firms, would mitigate the risk involved in these types of early-stage investments."

Read the full article in VentureBeat.

Equire is a marketplace for entrepreneurs to find and invest in traditional SMB's with $700k to $7m EBITDA. The Equire DealSource service helps Entrepreneurs find companies to acquire and operate, and the Equire DealFund service then helps entrepreneurs efficiently obtain capital from accredited investors to close their acquisition. For more information please visit equire.co or email info@equire.co.

Start with no: Find the right business faster by eliminating businesses that aren’t the right fit

3 filters to help you eliminate prospective businesses faster

Your time is valuable. Your search options vast. An efficient search process matters.

While there is no shortage of deal flow in the SMB space, a significant portion of that deal flow is made up of relatively un-buyable businesses.

A good searcher must develop search filters that equip her to quickly recognize which prospective businesses are not worth her valuable time conducting due diligence. With an initial screening structure, a searcher can tell whether to proceed with further due diligence or scrap a deal as quickly as possible.

1. It’s been listed in the past 90 days

Good businesses sell quickly. Developing a successful search is largely dependent on your ability to identify quality businesses as soon as they hit the market. From our experience, businesses that have been on the market for more than 90 days rarely end up being sold without an adjustment to the seller’s price expectations or the underlying offering. The most successful searchers develop or outsource processes allowing them to identify and quickly vet acquisition targets as soon as they become available.

2. A reasonable multiple indicates a good deal as well as reasonable seller

Be aware of the multiple ranges within the industries you are searching. If a multiple is too low, the business can likely be ignored. No owner is interested in extracting anything less than fair value from their business. If the multiple is too high, you’re likely dealing with an owner who possesses unreasonable expectations and is not prepared to let go of their business. Develop a firm understanding of multiple ranges and utilize that knowledge as one of your first filters when analyzing a business.

3. You have adequate knowledge and experience with this type of business

Before spending time vetting a business in a new industry, ask yourself if you have the skill base to manage this type of business. What are the characteristics and skills that a CEO in this industry must possess? Do you have these skills, and if not, is there a path through which you will be able to develop these skills? In a foreign industry, a river guide is often important. Do you have a network of knowledgeable professionals capable of and willing to provide mentorship when needed?

---

Equire is a marketplace for entrepreneurs to find and invest in traditional SMB's with $700k to $7m EBITDA. The Equire DealSource service helps Entrepreneurs find companies to acquire and operate, and the Equire DealFund service then helps entrepreneurs efficiently obtain capital from accredited investors to close their acquisition. For more information please visit equire.co or email info@equire.co.

Optimism Amongst EtA Investors

"The Evolution of Entrepreneurship Through Acquisition," Chicago Booth’s most recent EtA research paper overviews the search industry, from its origins to its current landscape. The paper touches on topics such as historical rates of return, common acquisition structures, the changing profile of the entrepreneur, and alternative forms of EtA.

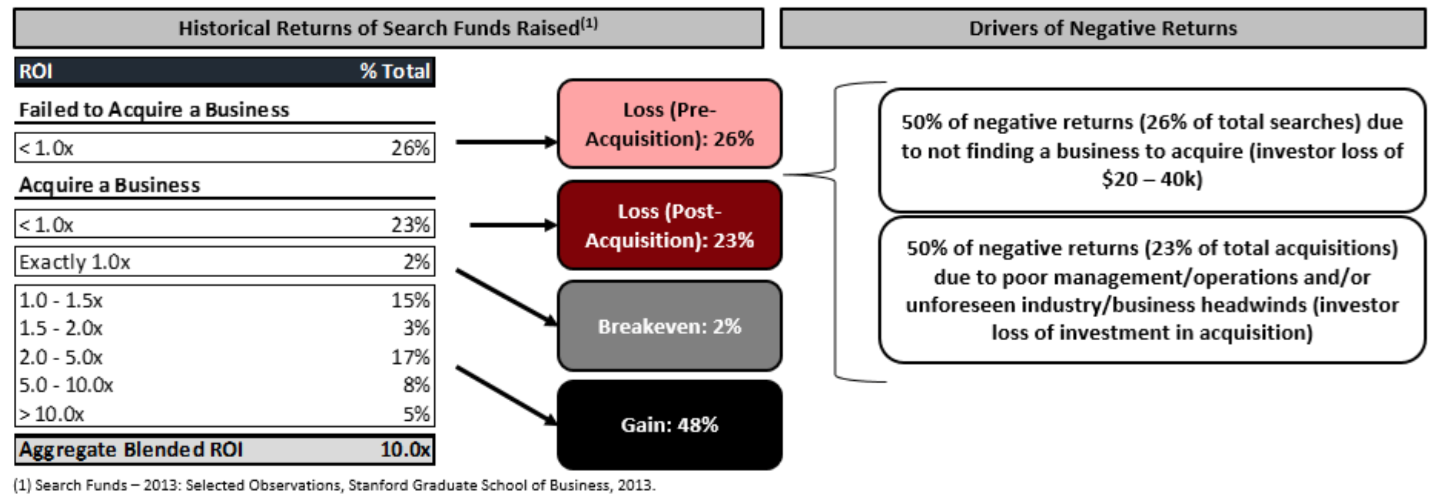

“Since inception, the traditional search fund model has generated a cumulative IRR of 34.9% and ROI of 10.0x (this data is from search funds raised between 1983–2013, according to Stanford GSB). These data account for 177 total search funds raised, of which 32 were still searching at the time and 11 had other/unknown outcomes. Of the remaining 134 search funds, 99 (74%) had successfully acquired an operating company.”

“Investors are optimistic about ETA for many reasons. Chief among them is the pool of available small businesses and the aging American demographic, which combine to create an extremely attractive opportunity for entrepreneurship through acquisition.

“One interesting observation is that searchers appear to be heavily influenced toward certain models based on which school they attend. For example, Stanford students tend to choose the traditional search fund route, likely because so many of the faculty and alumni are still actively involved in that community. HBS searchers tend to self-fund; more alumni have chosen that route and prominent faculty encourage it. We expect both these trends to have major impacts going forward.”

Download the full report HERE.

Equire is a marketplace for entrepreneurs to find and invest in traditional SMB's with $700k to $7m EBITDA. The Equire DealSource service helps Entrepreneurs find companies to acquire and operate, and the Equire DealFund service then helps entrepreneurs efficiently obtain capital from accredited investors to close their acquisition. For more information please visit equire.co or email info@equire.co.

Analyzing M&A Opportunities & Determining Value

"The Big Idea: The New M&A Playbook," published by the Harvard Business Review, explains why the majority of acquisitions fail and how business buyers can ensure a higher chance of success by adopting the right approach to analyzing M&A opportunities.

"Some managers hold out hope that buying another company for its resources can unlock unexpected growth, but they are likely to be disappointed."

"If managers grow cash flows at the rate the market expects, the firm’s share price will grow only at its cost of capital, because those expectations have already been factored into its current share price. To persistently create shareholder value at a greater rate, managers must do something that investors haven’t already taken into account—and they must do it again and again."

"The most reliable sources of unexpected growth in revenues and margins are disruptive products and business models. Disruptive companies are those whose initial products are simpler and more affordable than the established players’ offerings."

"Given our assertion that RBM acquisitions most effectively raise the rate of value creation for shareholders, it’s ironic that acquirers typically underpay for those acquisitions and overpay for LBM ones... The stacks of M&A literature are littered with warnings about paying too much, and for good reason. Many an executive has been caught up in deal fever and paid more for an LBM deal than could be justified by cost synergies. For that kind of deal, it’s crucial to determine the target’s worth by calculating the impact on profits from the acquisition."

"Ultimately, the “right” price for an acquisition is not something that can be set by the seller, far less by an investment banker looking to sell to the highest bidder. The right price can be determined only by the buyer, since it depends on what purpose the acquisition will serve."

Read the full article in the Harvard Business Review.

Equire is a marketplace for entrepreneurs to find and invest in traditional SMB's with $700k to $7m EBITDA. The Equire DealSource service helps Entrepreneurs find companies to acquire and operate, and the Equire DealFund service then helps entrepreneurs efficiently obtain capital from accredited investors to close their acquisition. For more information please visit equire.co or email info@equire.co.

Detailing an Active Search Fund in Dallas

"Why Many Entrepreneurs Are Turning to a ‘Search-Fund’ Model," a recently published article in D Magazine, familarizes novices with the concept of entrepreneurship through acquisition. The article details Simone and Malcolm Collins, a young married couple who recently raised $600K to conduct a search for a small business to acquire.

"Also known as “entrepreneurship through acquisition,” the relatively new but increasingly popular business model involves raising a pool of capital from investors in order to locate and acquire an existing, privately held company."

"Last spring... the couple was able to secure $600,000 from 17 investors for the search part of their quest, which could last as long as two years. Once they identify a company to buy—they’re looking now at targets with $5 million to $50 million in annual revenue, in a variety of industries—their investors will serve as advisers and have first-refusal rights to pony up the cash required to make the acquisition."

"Last May, for one example, Irving-based HousingWire, a media company specializing in the housing industry, was acquired by a search fund called Riomar Capital."

Read Glenn Hunter's full article in D Magazine.

Equire is a marketplace for entrepreneurs to find and invest in traditional SMB's with $700k to $7m EBITDA. The Equire DealSource service helps Entrepreneurs find companies to acquire and operate, and the Equire DealFund service then helps entrepreneurs efficiently obtain capital from accredited investors to close their acquisition. For more information please visit equire.co or email info@equire.co.

The Importance of Small Business and the SBA

In an article recently published by Harvard Business School Working Knowledge, Karen Mills discusses the importance of small businesses and the vital role the SBA plays in stimulating growth. Despite recent criticism, SBA loan guarantee programs, which enable banks to lend to small businesses (even at the height of the credit crisis), facilitate economic growth and create vast opportunity.

"A look under the hood at SBA... reveals a small but important agency... a public-private partnership driving valuable outcomes to a critical (but often neglected) part of the economy, all at a low cost to taxpayers."

"Half of the people who work in America either own or work for a small business. And small businesses have created 60 percent of all net new jobs since 1995..."

"SBA’s loan guarantee programs were actually a mechanism that helped unlock capital to small businesses at a time when most banks had stopped lending to small businesses altogether. In fact, SBA’s guarantee brought many banks back to small business lending, helping resuscitate this critical sector of our economy right where it was needed, on our nation’s Main Streets."

"While new private sector players like online lenders can help (provide loans to small businesses), they will certainly not replace the SBA. A well-functioning, low-cost agency—that expands access to credit to small businesses across America with an overall loss rate under 5 percent—should be viewed as a huge asset."

Read Karen Mills' full article in Harvard Business School Working Knowledge.

Equire is a marketplace for entrepreneurs to find and invest in traditional SMB's with $700k to $7m EBITDA. The Equire DealSource service helps Entrepreneurs find companies to acquire and operate, and the Equire DealFund service then helps entrepreneurs efficiently obtain capital from accredited investors to close their acquisition. For more information please visit equire.co or email info@equire.co.

The Case for Entrepreneurship Through Acquisition

Want to be an entrepreneur but don't have a groundbreaking idea? Maybe you lack industry contacts or are unable to take on the risks associated with traditional startups? "Should You Skip the Startup?," published by the Kellogg School of Management, explores entrepreneurship through acquisition with Brad Morehead, a business owner and Adjust Professor at Kellogg. Morehead discusses the advantages of EtA vs. starting-up and details the obstacles a business owner can expect to encounter post-acquisition.

"'A lot of startups are so concerned about demand risk that they keep what they’re doing secret,' Morehead says. “What’s nice about entrepreneurship through acquisition is that there’s no reason not to talk to people about what you’re thinking about buying. You can get real feedback faster to accurately assess demand risk."

"Making changes to an existing company—from changes in staffing to product mix to strategic focus—necessarily comes with some risk. An entrepreneur must be prepared to reassure nervous employees that both parties are working toward the same goals. Understanding their concerns is the first step in reassuring them that your concerns are aligned."

“There was all this fear about the jobs moving,” (Morehead) says. “Depending on the town you’re going into, that can have a real economic impact. But that just wasn’t something I’d thought about. My whole goal in acquiring this business was continuity.”

"Figuring out what style of entrepreneurship is the right fit for your personality is critical to the success of a venture. So while most people may not associate acquisition and passion, being jazzed about your new venture is not just the province of the startup entrepreneur."

Read the full article in KelloggInsight.

Equire is a marketplace for entrepreneurs to find and invest in traditional SMB's with $700k to $7m EBITDA. The Equire DealSource service helps Entrepreneurs find companies to acquire and operate, and the Equire DealFund service then helps entrepreneurs efficiently obtain capital from accredited investors to close their acquisition. For more information please visit equire.co or email info@equire.co.

Entrepreneurship Through Acquisition vs. Startups

The perils of starting a new company are well-documented, and buying an existing small business can often offer a more attractive path to business ownership. Krista Stein's recently published article in Fast Company discusses why aspiring entrepreneurs should consider purchasing an existing business en lieu of starting a new one.

"Contrary to what many believe, there are actually two main paths toward becoming a business owner: Start your own or buy an existing one. Both take long hours and hard work. But taking over an existing company from a retiring entrepreneur means you don't have to start from scratch—and it may pay off better than bootstrapping a startup."

"Over the next 20 years, retiring business owners will sell or bequeath $10 trillion worth of assets, held in more than 12 million privately owned businesses, according to the California Association of Business Brokers. More than 70% of those businesses will likely change hands, offering major opportunities for younger entrepreneurs."

"While private equity firms have been scooping up more small businesses in recent years, prospective individual buyers may have an edge; many retirees want to sell to someone with similar values, hopes, and dreams."

Read Krista Stein's full article in Fast Company.

Equire is a marketplace for entrepreneurs to find and invest in traditional SMB's with $700k to $7m EBITDA. The Equire DealSource service helps Entrepreneurs find companies to acquire and operate, and the Equire DealFund service then helps entrepreneurs efficiently obtain capital from accredited investors to close their acquisition. For more information please visit equire.co or email info@equire.co.

Small Business Acquisition vs Traditional Path: The More Profitable Route for MBAs

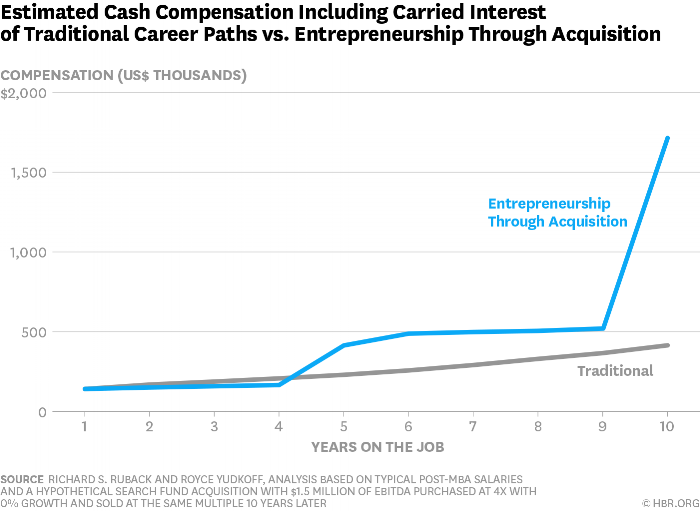

A recent Harvard Business Review article by Richard S. Ruback and Royce Yudkoff compares compensation between MBAs who choose to purchase an existing small business to own and operate with MBAs pursuing a traditional path such as banking or consulting.

The article assumes the average starting salary of graduates from elite MBA programs is about $150K, growing "at a 12% compound annual growth rate (CAGR) so that it more than triples in the first 10 years, which is in line with post-MBA salary surveys we’ve done here at the Harvard Business School" It also assumes "the cash compensation for a new CEO of a small business starts off at the average post-MBA salary, and its growth is generally tied to the performance of the company..."

Ruback and Yudkoff find, "The advantage to the traditional path in the early years is very much offset by the impressive EtA cash flows that occur once the carry starts getting paid and even more so upon exit (which we’ve assumed in year 10 in this example)." View their comparison below.

Read Richard S. Ruback and Royce Yudkoff's full article in the Harvard Business Review.

Equire is a marketplace for entrepreneurs to find and invest in traditional SMB's with $700k to $7m EBITDA. The Equire DealSource service helps Entrepreneurs find companies to acquire and operate, and the Equire DealFund service then helps entrepreneurs efficiently obtain capital from accredited investors to close their acquisition. For more information please visit equire.co or email info@equire.co.

Mainstream Portfolios see low chance of 5%+ yields until 2025 | Barron's

A recently published article by Barron's based on data provided by Research Associates states that:

"Portfolios dominated by mainstream asset classes have a very low probability of earning a 5% annualized real return over the next decade, but most investors are blithely overlooking this reality."

With the Shiller PE Ratio nearing a decade high, the modest 3-5x entry valuations and increasing accessibility of the SMB equity asset class can be a compelling alternative for accredited investors. Read Bloomberg's or Barron's article mentioning the study to learn more.

Equire is a marketplace for entrepreneurs to find and invest in traditional SMB's with $700k to $7m EBITDA. The Equire DealSource service helps Entrepreneurs find companies to acquire and operate, and the Equire DealFund service then helps entrepreneurs efficiently obtain capital from accredited investors to close their acquisition. For more information please visit equire.co or email info@equire.co.

The toughest questions to ask yourself before searching for a small-medium business to buy

Over his career, Tom Malloy has advised hundreds of entrepreneurs considering launching a search to buy a small-medium business. Here are a few of the toughest questions every prospective searcher should ask themselves.

- "Have you managed people at varying levels of education and age groups?"

- "Can you make timely decisions with limited resources?"

- "Are you intrinsically satisfied and motivated to be an independent SMB entrepreneur?"

- "Do you have the capital to fund your search and acquisition costs/equity?"

For more questions to ask yourself before beginning your search, read the rest of Tom’s article on Medium.

Equire is a marketplace for entrepreneurs to find and invest in traditional SMB's with $700k to $7m EBITDA. The Equire DealSource service helps Entrepreneurs find companies to acquire and operate, and the Equire DealFund service then helps entrepreneurs efficiently obtain capital from accredited investors to close their acquisition. For more information please visit equire.co or email info@equire.co.